south carolina inheritance tax 2021

Unlike some other states there are no inheritance or estate taxes in South Carolina. The top estate tax rate is 16 percent exemption threshold.

The True Cost Of Living In South Carolina

No estate tax or inheritance tax.

. INCREASE IN SOUTH CAROLINA DEPENDENT EXEMPTION line w of the SC1040 The South Carolina dependent exemption amount for 2021 is 4300 and is allowed for each eligible dependent including both qualifying children and qualifying relatives. For 2021 the nonrefundable credit is equal to 8333 of the. The District of Columbia moved in the.

South carolina inheritance tax and gift tax. However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina. This doesnt eliminate other expenses related to estate planning expenses such as inheritance tax that might come from another state or a federal estate tax.

There also might be expenses related to. South Carolina does not levy an estate or inheritance tax. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state.

If youre planning an estate or just inherited money it can be a good idea to. As of 2019 iowa kentucky maryland nebraska new jersey and pennsylvania have their own inheritance tax. April 14 2021 by clickgiant.

Make sure to check local laws if youre inheriting something from someone who lives out of state. On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through December 31 2024 and results in the repeal of the inheritance tax as of January 1 2025. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

There is no federal inheritance tax but there is a federal estate tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. April 14 2021 by clickgiant.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. You should also keep in mind that some of your property wont technically be a part of your estate. No estate tax or inheritance tax.

South Carolina Retirement - Taxes And Economic Factors To Consider. No estate tax or inheritance tax. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates.

As in north carolina south carolina does not tax social security benefits. In case you inherit a property from a resident of another state you will have to pay that states local inheritance tax. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the.

But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state. South Carolina does not assess an inheritance tax nor does it impose a gift tax. Large estates that exceed a lifetime exemption of 1206 million are subject to the federal estate tax.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. No estate tax or inheritance tax.

The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away.

There is no inheritance tax in South Carolina. No estate tax or inheritance tax. South Carolina also has no gift tax.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. A federal estate tax is in effect as of 2021 but the exemption is significant. 117 million increasing to 1206 million for deaths that occur in 2022.

Counties in South Carolina collect an average of 05 of a propertys assesed fair market value as property tax per year. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of. South Carolina Inheritance Tax and Gift Tax.

No estate tax or inheritance tax No estate tax or inheritance tax. South carolinians pay an average 601. However the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies.

South Carolina has no estate tax for decedents dying on or after January 1 2005. In this detailed guide of South Carolina inheritance laws we break down intestate succession probate taxes what makes a will valid and more. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. The top estate tax rate is. While South Carolina itself does not levy inheritance laws there may be cases when the states resident would still owe a related tax due.

April 14 2021 by clickgiant. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. 4 The federal government does not impose an inheritance tax.

Usually the taxes come out of whats given in the inheritance or are paid for out of pocket. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. The federal gift tax. There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be subject to it.

The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022.

South Carolina Estate Tax Everything You Need To Know Smartasset

![]()

Llc In Sc How To Start An Llc In South Carolina Truic

Call The Autonomy Group Today And We Can Assist You Will All Your Estate Planning Needs 803 262 0422 Or Visit Our W In 2021 Revocable Trust Estate Planning Estate Tax

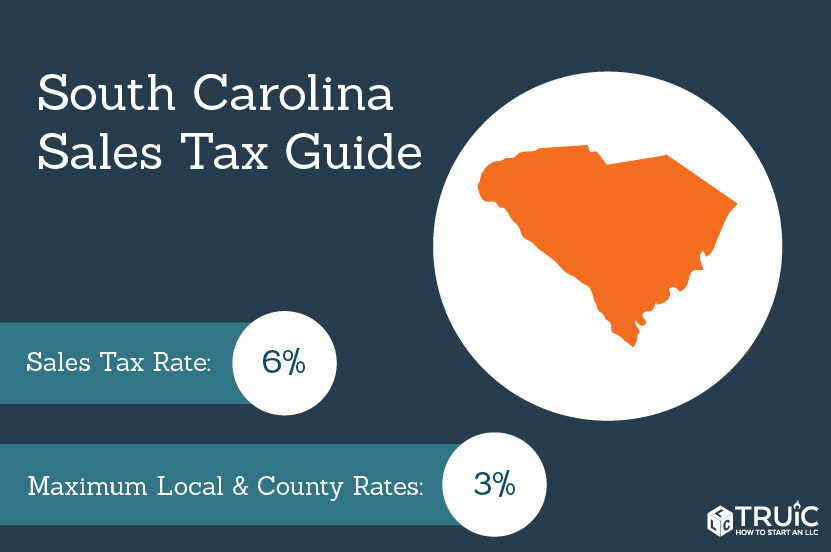

South Carolina Sales Tax Small Business Guide Truic

A Guide To South Carolina Inheritance Laws

A Guide To South Carolina Inheritance Laws

South Carolina Landlord Tenant Laws Update 2020 Payrent

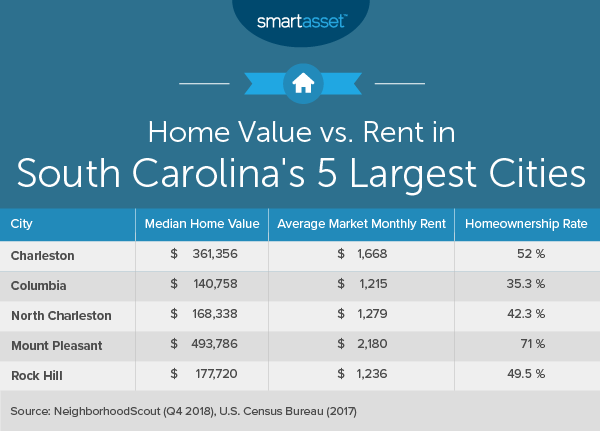

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Income Tax Calculator Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

Cost Of Living In South Carolina Smartasset

South Carolina Retirement Tax Friendliness Smartasset

Ultimate Guide To Understanding South Carolina Property Taxes

Real Estate Property Tax Data Charleston County Economic Development

Where S My Refund South Carolina H R Block

South Carolina Retirement Taxes And Economic Factors To Consider